Video

How to upload a receipt

You made an eligible purchase with an Optum Financial payment card. Learn how to upload an itemized receipt or an explanation of benefits.

How Do I Upload a Receipt?

Narrator:

You’ve recently made an eligible purchase with your Optum Financial payment card. In order to verify your transaction, you may be asked to upload an itemized receipt or an explanation of benefits. It’s easy to do! Just make sure your receipt includes the following:

The name of the person who received the care plus the name of the provider or merchant,

The exact amount of the expense, the date of purchase, and a detailed description of the service or items purchased.

Take a picture of your receipt or Explanation of Benefits with your phone or scan the image and save it to your computer. Now it’s time to upload!

Sign in to your account on the mobile app or online. Claims that need documentation are flagged. If you are on your computer, follow the screen instructions to select and upload your receipt image from your computer. Or, from the mobile app, follow the screen instructions to select an image from your phone, or snap an image within the app. Here is a tip: submitting documentation through the mobile app is easier, faster and more convenient.

Most expense reviews are completed in 2-to-4 business days. If there’s ever a problem, we will notify you by email or a letter in the mail, so, be sure your contact information is up to date. Or, sign back in to your account to view the status of your claim.

Learn about how to upload a receipt

You’ve recently made an eligible purchase with your Optum Financial payment card. In order to verify your transaction, you may be asked to upload an itemized receipt or an explanation of benefits. It’s easy to do. Just make sure your receipt includes the following:

- The date of the purchase

- The exact amount of the expense

- The name of the provider or merchant

- The name of the person who received the care

- A detailed description of the service or items purchased

Related resources

Spending your FSA dollars

Flexible spending accounts (FSAs)

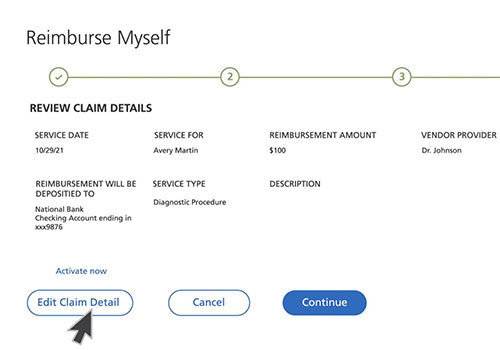

How to file a claim

Self-directed mutual fund investment options are made available through the services of an independent investment advisor, or your plan sponsor. Discretionary advisory services are provided by Betterment LLC, an SEC-registered investment adviser, with associated brokerage transactions provided by Betterment Securities, Member FINRA/SIPC. For details and disclosures visit betterment.com. The Schwab Health Savings Brokerage Account is offered to certain account holders through Charles Schwab & Co., Inc., Member FINRA/SIPC. For details and disclosures, visit schwab.com. Brokerage services are offered to certain accountholders through TD Ameritrade, Inc., Member FDIC/SIPC and a subsidiary of The Charles Schwab Corporation. For details and disclosures, visit tdameritrade.com.

Orders are accepted to effect transactions in securities only as an accommodation to HSA owners. Optum Financial and its subsidiaries are not broker-dealer or registered investment advisors and do not provide investment advice or research concerning securities, make recommendations concerning securities, or otherwise solicit securities transactions.

Health savings accounts (HSAs) are individual accounts offered through Optum Bank®, Member FDIC, or ConnectYourCare, LLC, an IRS-Designated Non-Bank Custodian of HSAs, each a subsidiary of Optum Financial, Inc. Neither Optum Financial, Inc. nor ConnectYourCare, LLC is a bank or an FDIC insured institution. HSAs are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties. State taxes may apply. Fees may reduce earnings on account.

Flexible spending accounts (FSAs), dependent care assistance programs (DCAPs), health reimbursement arrangements (HRAs), Commuter and Parking Benefits, Tuition Assistance Plans, Adoption Assistance Plans, Surrogacy Assistance Plans, Wellness Benefits, and Lifestyle Accounts (collectively, “Employer-Sponsored Plans”) are administered on behalf of your plan sponsor by Optum Financial, Inc. or ConnectYourCare, LLC (collectively, "Optum Financial") and are subject to eligibility and restrictions. Employer-Sponsored Plans are not individually owned and amounts available under the Employer-Sponsored Plan are not FDIC insured. This communication is not intended as legal or tax advice. Federal and state laws and regulations are subject to change. Please contact a legal or tax professional for advice on eligibility, tax treatment, and restrictions. Please contact your plan administrator with questions about enrollment or plan restrictions.

Google Play and the Google Play logo are trademarks of Google LLC. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

The promotional code OPTFSA7, OPTHSA5 and OPTHRA7 cannot be applied to previously placed orders, and cannot be combined with other promotional codes. Additionally, the code cannot be used for prescription drugs or virtual care visits. Promotional codes are not transferable or redeemable for cash or credit. To apply a promotional code you must enter it prior to completing the order.

Free and expedited shipping offers do not apply to shipping outside of the contiguous United States. Additional shipping restrictions may apply.

The Optum Store is an affiliate of the UnitedHealth Group family of companies.

Your employer sponsored plan may exclude reimbursement for certain categories of items. Check your plan document and summary plan description or contact your benefits department for specific coverage details.

© 2022 Optum, Inc. All rights reserved

Investments are not FDIC insured, are not bank issued or guaranteed by Optum Financial or its subsidiaries, including Optum Bank, and are subject to risk including fluctuations in value and the possible loss of the principal amount invested.